We invest in promising teams, where technology is a key component of the business model. Leveraging our unique background and experience, we seek to find the best teams with the right ideas within Marketplaces, B2B Saas, and Tech Platforms. If you have a proven market fit, a steady growth, and would like to grow even faster, then we would be happy to hear from you.

SCALING NORDIC TECH COMPANIES WITH HANDS-ON PASSION!

With Focus on Tech Teams

We will help you scale your platform, establish distribution network and professionalize your sales organization globally. We will scale your company outside the Nordics, into Europe, the US, and China through our global network.

We believe that the team is everything together with exceptional timing! We love commitment and Scale Leap Capital is dedicated to the following areas:

Our Investment Process

Screening Businesses

We will work through our partner network, our teams in Oslo, and partners in Stockholm to follow and interact with the right companies which have proven a solid track record through their early phase.

Investment Decisions

We will aim to make 10 new investments the next five years, with focus on team, timing, and investment area

Facilitate Growth

We put cash in for rapid scale-ups, to help bring the team’s vision to life. We make introductions, and fuel global ambitions through working hands-on with management and the board.

Exit

We are not locked to any fixed cycles. Whether to a strategic buyer or as an IPO, companies exit when they reach maturity or when they have established a strategic position in the ecosystem.

With focus on Sustainability

Our team has significant experience in leading global ESG mapping and improvement projects. This experience will be used in the investment process of our portfolio companies and in our continuous management after the investment has been made.

Our potential fund will always seek to conform to the highest ethical standard for our investments, in our own business conduct and for the investors, we invite to join us.

Our Team

He is the co-founder of the SW company Gture and co-founder and Chairman of the early phase investment company Gvalueinvest. He has managed large organizations internationally and has extensive experience in founding and operating start-ups and early phase companies. Rolv-Erik has 25 years of experience in the internet and telecom industry. He has been part of Alcatel Norway management and Telenor Executive Group Management as head of Telenor Digital, where he led Telenor's global focus on innovation and development of digital services and new business areas. He has also held positions as CTO Telenor Norway and Head of Telenor Business Norway. He has extensive experience from several board positions from a variety of companies, such as Norwegian Finance Holding ASA, Grieg Group Maturitas AS, Telenor Broadcast Holding AS, and Tise AS. Rolv-Erik has a Master Sc in Mathematics with a major in Numerical Mathematics and Differential Equations. He has also completed Alcatel International Master and Telenor Strategy Master on INSEAD.

Ingvild holds a MSc in Quantum Physics from the University of Oslo, MSc in International Strategy, BSc in Relational Psychology and Depth study in Corp Finance.

Portfolio

![]()

Domos is a software company for Internet Service Providers, offering real-time monitoring, analysis, and optimization of network quality to improve end-to-end latency. The software helps identify bottlenecks in customers’ WiFi or broadband connections, enabling optimization for ISPs, application providers, and end customers. With current usage in over 300,000 homes in the Nordics and the UK, Domos plans to expand to millions of households in Europe and the US, positioning itself as an industry leader.

Defigo provides a cutting-edge and user-friendly access control solution, revolutionizing building management and elevating convenience for residents. This advanced solution empowers users to effortlessly control access via their smartphones, manage permissions with ease, and personalize doorbell settings according to their preferences. Designed with safety and convenience as top priorities, Defigo caters to every type of property. With its intuitive interface, the solution allows you to open and manage your door right from your cell phone, giving you complete control over who has access to your property. Additionally, you can customize your doorbell to suit your individual preferences, ensuring a seamless and personalized experience for every user.

Defigo provides a cutting-edge and user-friendly access control solution, revolutionizing building management and elevating convenience for residents. This advanced solution empowers users to effortlessly control access via their smartphones, manage permissions with ease, and personalize doorbell settings according to their preferences. Designed with safety and convenience as top priorities, Defigo caters to every type of property. With its intuitive interface, the solution allows you to open and manage your door right from your cell phone, giving you complete control over who has access to your property. Additionally, you can customize your doorbell to suit your individual preferences, ensuring a seamless and personalized experience for every user.

Bluestone PIM, a SaaS company, delivers a product information system (PIM) for retailers, wholesalers, and ecommerce. Bluestone is recognized for its adaptability and comprehensive capabilities – leading the growth in composable enterprise architecture. Bluestone PIM is in the forefront of the MACH alliance, an industry protected brand certification for software enterprises, system integration partners and sales partners being truly based on Microservices (M), API-first (A), cloud native (C) and headless (H).

Our History

Scale Leap Capital is a new fund that was founded in 2021. After being investing in early phase companies for many years through Gvalueinvest, BoddCo, and Stayer Invest, the founders decided to focus on scale-up phase in the Nordic region. The reason is that we strongly believe that the team is key for success and that their capability has been proven even better when entering the scaling phase. Another aspect is that we can contribute more and better in an active role when you as a founder have got a proven market-fit and are ready to scale internationally. We love to work hand-on, and our experience is spanning from executive management positions to principle coding. We will work to realize your dream long-term with passion.

Contact.

Feel free to contact us and we will be happy to discuss the possibility of future investments.

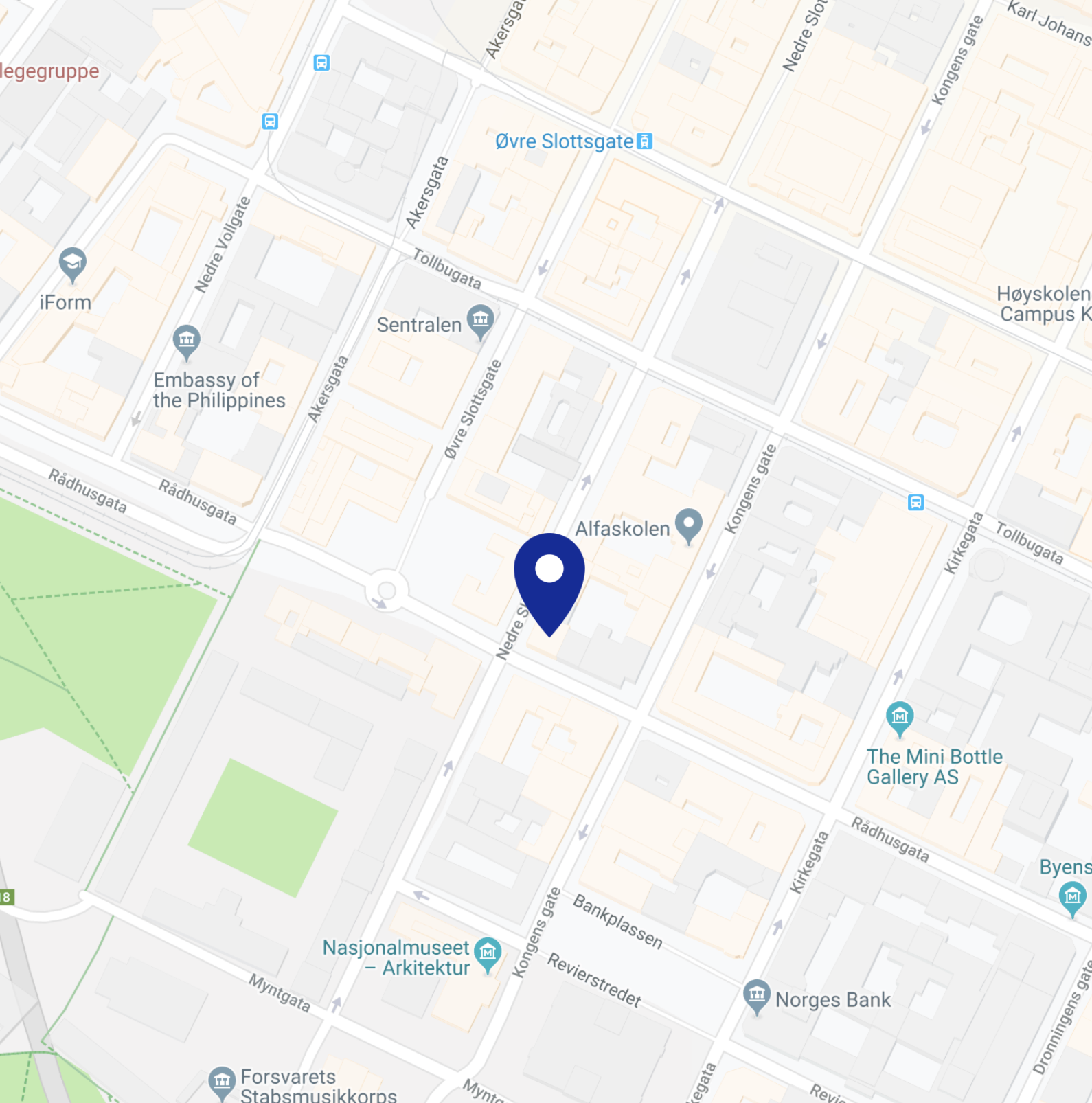

Rådhusgata 17

0158 Oslo

SFDR

At Scale Leap Management AS (“Scale Leap” or “we”), we focuse on investments in late venture early growth phase. Our investments are companies with business models built on software technology: platform companies, marketplaces and B2B SaaS. Such companies present a range of opportunities to contribute meaningfully to the welfare of both people and planet, and do in general have few negative consequences on society. We consider sustainability in all we do and view it as a strategic tool for financial returns and a license to operate.

In order to secure our overall objective, Scale Leap has adopted an ESG Investment and Risk Policy which is integrated in our pre-investment process, in our investment period and post investment process. Our top level policy is available here.

Sustainable related product disclosures for Scale Leap Capital 1

Scale Leap is the alternative investment fund manager for the alternative investment fund Scale Leap Capital 1 (the “Fund”). The Fund is covered by article 8 of Regulation (EU) 2019/2088 on sustainability related disclosures in the financial sector (“SFDR”).

Scale Leap is therefore required to include a sustainability related product disclosure section on its website, pursuant to article 10 of SFDR. These disclosures are available here.